Safe Deposit Box Chase

Chase Bank Fees

A large international bank like Chase gives customers access to a huge network of ATMs and branches almost anywhere, however, it also typically charges fees for its accounts. These charges include Chase overdraft fees, monthly services fees, checking account fees, wire transfer fees and ATM fees for using a non-Chase machine. Chase bank does also offer up to date options for mobile and online banking.

Banking with Fee-Free Overdraft

Chase Bank Safe Deposit Boxes

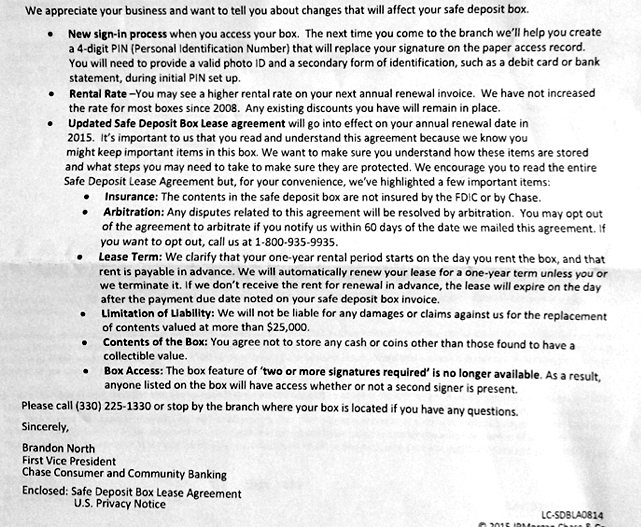

- Wells Fargo’s safe-deposit-box contract caps the bank’s liability at $500. Citigroup limits it to 500 times the box’s annual rent, while JPMorgan Chase has a $25,000 ceiling on its liability.

- No Chase fee on first four non-Chase ATM transactions 5 No annual rent for a 3” x 5” Safe Deposit Box or smaller (20% discount on larger sizes); sizes are subject to availability and boxes may not be offered in all branches No fee for counter checks, money orders and cashier's checks.

- Banks With Safe Deposit Boxes Deposit Boxes The following banks and credit unions offer safety deposit rental services for their customers and account holders. We obtained up-to-date pricing information either from the bank’s website or by contacting customer service.

Safe deposit box. Chase will provide you with a 3 x 5 Safe Deposit Box and even a 20% discount for larger boxes. As a side note: if you allow someone to co-sign on the safety deposit box, that might be a way to get them into the Chase Private Client program. See full list on firstquarterfinance.com.

✓ Overdraft up to $100 with no overdraft fees

✓ No hidden bank fees

✓ Grow your savings automatically

Signing up is free and takes less than 2 minutes.

Learn how we collect and use your information by visiting our Privacy Policy›

How Much Does It Cost To Open A Chase Bank Account?

The minimum deposit for a Chase bank account depends on what type of account that you want to open. Chase bank offers three types of checking accounts: Chase Premier Plus Checking, Chase Total Checking and Chase Premier Platinum Checking. All three of these types of accounts have a monthly maintenance fee. The most significant difference between the three types of Chase checking accounts is that Chase Premier Plus accounts, both the regular and Platinum accounts, pay interest but Chase Total Checking does not.

Chase Total Checking

Chase Total Checking is a basic checking account. The monthly service fee for a Total Checking account is $12, but there are ways that you can get that service fee waived. Total Checking requires a minimum deposit of $25 to open an account. That $12 fee is cut in half for students currently enrolled in high school or college. Total Checking account holders pay no Chase ATM fees at any in-network ATM and deposits can be made at in-network ATMs as well. Total Checking account holders also have full and free access to Chase’s online banking and online bill paying features.

Chase Premier Plus Checking

For people who want to earn interest on their money, there is the Chase Premier Plus checking account. This account has a higher service fee of $25 per month. The current interest rate paid on the balance of the account is 0.01% although that does change. The minimum amount required to open a Premier Plus checking account is $25. Those who have the Premier Plus checking account also can use any of Chase’s in-network ATMs for free and get 24-hour online banking access and online bill pay as well as Chase customer service.

People who open a Premier Plus checking account also get the standard fee for using an out-of-network ATM waived for up to four transactions per month. Chase Premier Plus checking account holders also don’t have to pay a fee on any other Chase accounts that they hold.

Chase Premier Platinum Checking

The monthly service fee for a Premier Platinum account is $100 but it is possible to get that fee waived. And the Premier Platinum checking account comes with big perks. You will get all the perks that come with a Premier Plus checking account plus:

- No ATM fees, even out-of-network

- No fee for personal checks

- No fee for cashier’s checks or counter checks

- No fee for debit card replacement

- No fees for returned items or insufficient fund items

- No wire transfer fee

- No extended overdraft fee

- Free annual use of a small safe deposit box

Another benefit is priority service and 24-hour live help. You’ll always be able to reach an actual human being to help you manage your account or answer your banking questions with a Chase Premier Platinum account.

Types of Fees

Here is a basic rundown of the types of fees charged for savings accounts, checking accounts, overdraft and more:

Savings Accounts

The basic monthly fee for a Chase saving account is $5. However, saving account fees are waived if you have a savings account that is tied to a Premier Plus or Premier Platinum checking account. You can also get the saving account fees waived if you have a minimum daily balance of $300 or more or if you have an automatic repeating transfer of $25 or more into the savings account each month. If you have a Chase savings account and you are under 18 years old, there is no monthly service fee.

Checking Accounts

Chase Total Checking accounts have a $12 monthly fee for everyone except students. Students pay a Chase monthly checking account fee of $6. Total Checking account fees can be waived if you have a daily balance of $1500 or more. You can also get the monthly fee waived if you have more than $500 in Direct Deposits each month into the account. The third way to avoid paying the monthly fee is to maintain $5000 or more in deposits or investments across several Chase accounts.

Safe Deposit Box Chase Ny

The Chase Premier Plus checking account comes with a $25 monthly fee. Customers can get that waived by maintaining a daily balance of $15,000. The monthly fee can also be waived if you have a Chase first mortgage and you are enrolled in automatic payments on that mortgage.

The monthly service fee for a Chase Premier Platinum account is also $25. That fee is waived if you maintain a daily balance of $75,000 or more.

Chase ATM Fees

Chase doesn’t charge an ATM fee if customers use any of the 16,000 network ATMs. There is a $2.50 fee per transaction to use any ATM that isn’t in the Chase network within the United States. Using an international ATM that isn’t in the Chase network will cost $5 per withdrawal and $2.50 for a balance inquiry or to transfer money. Those are on top of any fees that the ATM owner charges. The ATM withdrawal limit is $1000 per day.

Overdraft And Insufficient Funds Fees

Chase overdraft fees are $34 per item that is returned or has insufficient funds. Items that are less than $5 or overdraw the account by less than $5 won’t be charged the $34 fee. Up to three overdraft charges can be assessed per day. In addition to the $34 overdraft fee per item if the account stays overdrawn for more than five days there is an additional $15 charge every five days called an extended overdraft fee.

Safe Deposit Box Chase Bank Appointments

Penalties and Withdrawal Limits

If you have a Chase savings account there are withdrawal limits you need to know about. If you make more than six withdrawals from your savings account in a month, Chase will charge a $5 fee, and they will also automatically change your savings account to a checking account.

2 minutes with no impact to your credit score.

The best way to go to Chase.com:

- Make sure your cookies are enabled. See our Online Privacy Policy to learn why we use cookies.

- Check your browser to see if you have the latest version.

Not sure what browser version you're using? Go to whatsmybrowser.org to get details about your current browser. Once you have this information, update your browser using the links above. - When updating your browser, consider this:

- Some features and functions may not operate properly with unsupported browser versions.

- We don't support beta or development browser versions. The browser has to be an officially released version.

- If you're using the latest officially released browser version, there might be a slight delay in our supporting this version as we must conduct testing to ensure it not only meets our strict security standards but also supports all our online features and enhancements.

- We don't support browsers in Compatibility Mode (this only applies to Internet Explorer).

- We don't support third-party browser extensions or plug-ins.