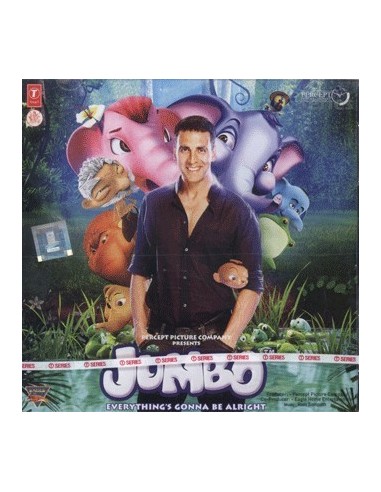

Jumbo Cd

:format(jpeg):mode_rgb():quality(90)/discogs-images/R-5664640-1399490422-2914.jpeg.jpg)

Jumbo CDs are simply a variety of conventional certificates of deposit, requiring a higher initial deposit to open. Characteristics such as having a fixed maturity term and rate, and charging a. A jumbo CD is a certificate of deposit that traditionally requires a minimum deposit of $100,000. Some banks and credit unions offer jumbo CDs with lower minimums, such as $50,000. A CD (certificate of deposit) is a type of deposit account that’s payable at the end of a specified amount of time (referred to as the term). CDs generally pay a fixed rate of interest and can offer a higher interest rate than other types of deposit accounts, depending on the market. I saw 'Jumbo' when I was in college, back in the 60's. I loved musicals; I loved 'Jumbo.' I have always enjoyed the music of Doris Day, especially that she recorded in the 60's. Her voice, her music, holds up well all of these years later. As someone put across in a recent bio, she may be the best of the girl singers. A jumbo certificate of deposit (or jumbo CD) is a CD that has a balance of at least $100,000. At this level, you can typically earn a higher amount of interest on your CD versus another CD with a lower deposit amount. A certificate of deposit, or CD, is a great place to store cash.

A jumbo CD is a certificate of deposit in a very large denomination, usually at a minimum of $100,000. Also called negotiable certificates of deposit, these large investments are considered low-risk, stable investments for large investors.

Jumbo Cd

A jumbo CD has the same basic characteristics as a traditional certificate of deposit. They are considered 'time deposits' because they lock up an investor's principal for a set time period, typically ranging from three months to six years. In exchange for tying up principal, the investor earns a guaranteed return at a set percentage rate locked in at the time of purchase. This return is payable when the CD matures, or reaches the end of the predetermined time period.

Like a traditional CD, a jumbo CD is considered a very low risk investment. Certificates of deposit are FDIC-insured, and therefore guarantee a return of principal. FDIC insurance, however, will only cover up to $100,000 for this type of investment, and therefore most jumbo CDs and any returns are not FDIC-insured. This caveat inherently raises their investment risk to higher than that of a traditional CD.

As with smaller denomination CDs, a jumbo CD can typically deliver a higher rate of return than comparable cash investments such as money market accounts or savings accounts. The certificate rate of return directly correlates to the amount of time that the principal remains locked. The longer that it takes a CD to mature, the higher the rate of return. For example, a six-year CD will carry a higher interest rate than the same amount of principal locked in a six-month CD. Due to the commitment of such large amounts of money, a jumbo CD rate of return is better than that of a smaller CD with the maturity date.

Jumbo Cd Rates In Florida

In exchange for a slightly higher rate of return,certificates of deposit do not have the liquidity that other savings vehicles carry. Withdrawing principal early results in penalty fees or a forfeiture of a portion of returns, and those penalties can be particularly severe with a jumbo CD.

Jumbo Cd Rates At Banks

Due to the large principal involved, jumbo CDs tend to be cash instruments for institutional investors such as banks or pension funds, both organizations with significant capital seeking stable investments. A jumbo CD can also be of value to high-net worth individuals with large cash holdings looking for a guaranteed return without need to access principal in the short term.