Bank Of America Direct Deposit

The Bank of America direct deposit form may be used If you receive any kind of recurring payment, such as a salary, a pension or social security payments as an easy way to avoid the necessity of recurring trips to the bank to make those deposits in person.

With Direct Deposit, you also have the advantage of instant access to your funds at any Bank of America Branch office, through telephone banking or online. You also have the opportunity to split your deposit among any of your Bank of America checking, savings or money market accounts in any way that is convenient for you.

If your check is issued by the U.S. Treasury, you can arrange for direct deposit at a Treasury website. If you are already a Bank of America Customer who uses the bank’s online banking facility, you can login at any time to arrange for Direct Deposit. If you don’t use online banking you can obtain a Bank of America Direct Deposit Form from any branch office or from the bank’s site online.

How to Fill-in

Bank of America. When does a direct deposit hit your account? Most direct deposits credit your account in “real time” on the day your employer makes the deposit. However, it can vary depending on the instructions provided by the originator. It can be different for every customer and is determined by the sender. Find a Bank of America; BECU. Welcome to CashPro.

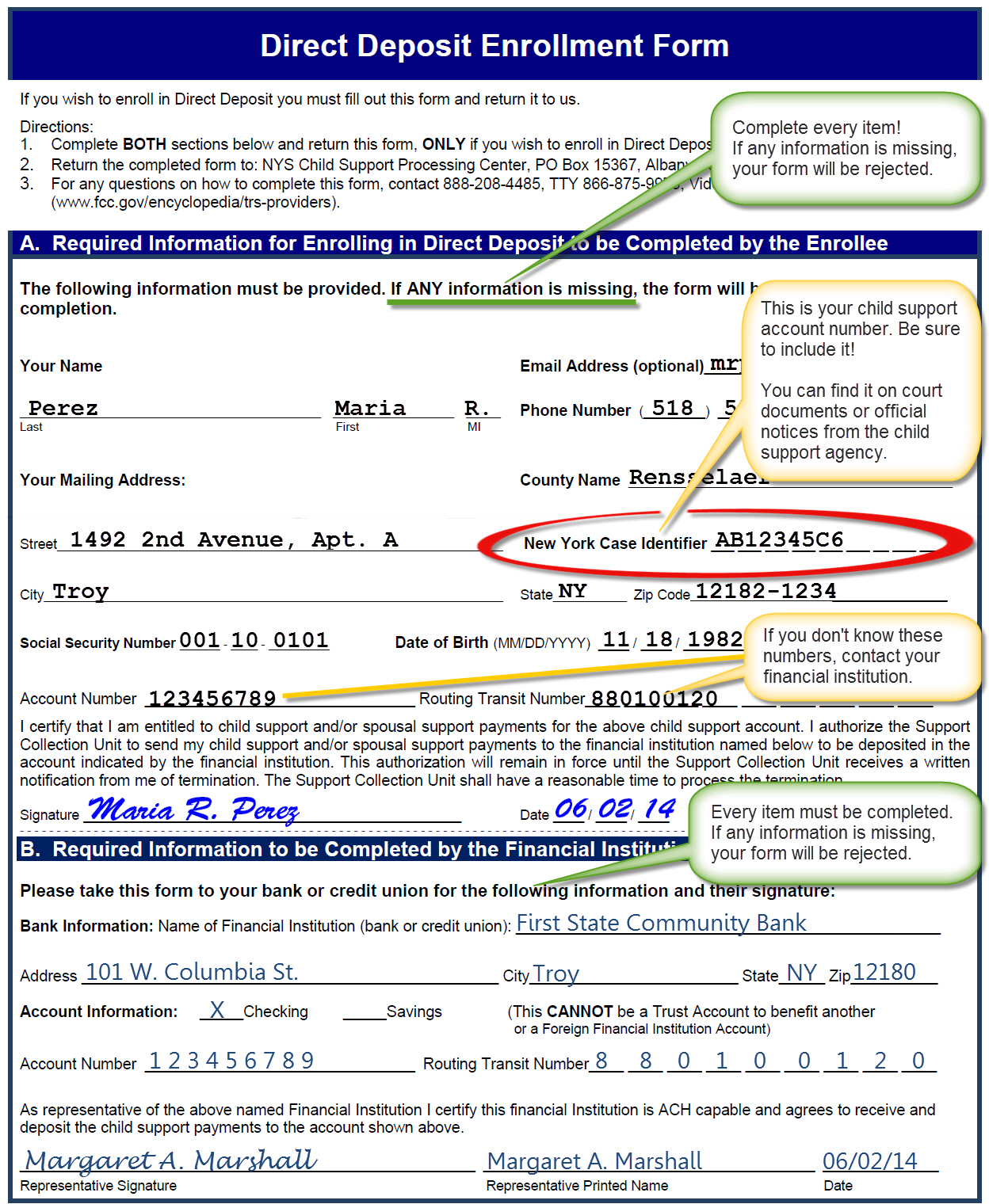

At the top of the Bank of America Direct Deposit Form you will notice some instructions. Notably, the form indicates that if the company prefers or the use of their own direct deposit form rather than one, it is permissible. It also notes that it isn’t necessary for company to return the form to the Bank of America once the information has been used to set up direct deposit on its payroll system.

The company (or employer) disbursing the recurring payments uses first section of the form to identify itself. The first line of this section is for the organization’s name. The next and final line of this section is for the organization’s full address.

Setup Bank Of America Direct DepositTry Cash App using my code and we’ll each get $5! RCXZXGP Check: https://amzn.to/2M. Bank of America offers a number of checking and savings accounts. Like most banks, it charges monthly fees depending on the account you have, but it also has options for avoiding those fees. Customers can avoid Bank of America’s fees in several ways, such as by setting up approved direct deposits or fulfilling account balance requirements.

Directly below on the bank of America Direct Deposit Form are the routing requests that you will now be making for the deposits of your funds. These deposits will be known as ACH Credits. With this form, you can distribute your fund to up to three different Bank of America accounts, so this section has three distinct parts. If you will be depositing everything to only one account, you’ll only need to fill in the first part.

You will check either savings or checking, depending on what type of account you are depositing into. Then, fill in the Account Number. Below that, fill in the ABA Routing Number, which is a unique number separately identifying every U.S. bank. The next and final line of each part of this section is for the Deposit Amount. You can fill in either a percentage of the payment, or an absolute dollar amount.

The very last box is only relevant if you are splitting your deposit over more than one Bank of America account. This choice is for “Remaining.” It simply means that whatever portion of your recurring deposit hasn’t been specified in the first or second parts of this section of the form is to go into this specific account.

Bank Of America Non Federal Direct Deposit

Finally, the very last section of the Bank of America Direct Deposit Form is where you supply your name, address, telephone number, the date and your signature.